“You don’t want to be found dead after a shoot-out with unused ammunition.”1 That was the refrain of one Federal Reserve (Fed) official in the wake of the Great Recession, amidst the backlash surrounding the Fed’s then-dramatic and unorthodox intervention in the economy. In the twenty-first century, central banks’ ability to conduct monetary policy through conventional means (namely, changes to interest rates) has proven limited, forcing central banks to resort to novel and controversial tools to combat economic downturns. These tools — such as quantitative easing and large-scale lending programs — carry with them the potential of political and distributional impacts, challenging traditional notions of central bank independence.2 Crises necessitating cross-institutional cooperation between central banks and national governments have proven particularly challenging in the United States, where lines are strictly drawn between the monetary and fiscal apparatuses of the federal government.3

Enter COVID-19. In March 2020, when economic activity in the United States came to a screeching halt, the Fed was forced to test out its post-2008 crisis-response toolkit for the first time. In concert with Congress and the Department of the Treasury, the Fed would make more than $454 billion available to financial and nonfinancial businesses, states, and municipalities.4 Miraculously, leveraging its emergency powers under section 13(3) of the Federal Reserve Act,5 the Fed would loosen calcifying credit markets across the economy and restore the functioning of the financial system.

Almost as quickly as the Fed mounted its heroic response, skepticism surrounding the intervention permeated academic and policy circles alike. With the benefit of hindsight, however, this Note aims to problematize some of the qualms and critiques surrounding the Fed’s actions in 2020. It contributes to the discussion by cataloging the most enduring of these criticisms and examining how each, in retrospect, has held up. Specifically, this Note contends that the Fed’s emergency lending during the crisis did not overstep the Fed’s statutory authority, was not so novel nor unprecedented, presented no risk to the American taxpayer, did not leave the Fed with discretion to “pick winners and losers,” and was subject to real and consequential limitations.

This Note proceeds as follows. Part I discusses the historical evolution of the relationship between the Treasury, the nation’s fiscal policy authority, and the Federal Reserve, the nation’s monetary policy authority, in addition to the development of the Fed’s lender-of-last-resort powers under section 13(3) of the Federal Reserve Act. Part II describes the Fed’s actions during the 2008 and 2020 financial crises and the respective political responses. Part III catalogues the tensions between section 13(3) of the Federal Reserve Act and the Fed’s COVID-19 response, arguing that the Fed’s intervention was well within the letter of the law. Finally, Part IV attempts to debunk some of the stickier myths surrounding the Fed’s actions during March and April 2020.

I. Setting the Scene

A. The Fed and the Treasury

The Department of the Treasury was established by the First Congress of the United States in 1789.6 The Constitution of 1787 had allocated to Congress the so-called “power of the purse,” or the ability to collect taxes and spend public money on behalf of the federal government.7 Congress established the Treasury Department to facilitate the exercise of that power by “receiv[ing] and keep[ing] the monies of the United States, and . . . disburs[ing] the same” in accordance with “appropriations by law” — in other words, in accordance with laws passed by Congress.8 Today, the Treasury Department is led by a single Secretary, appointed by the President with the advice and consent of the Senate9 and removable at will by the President.10

It was not until more than a century after the Department was created — in 1913 — that Congress would establish the Federal Reserve.11 According to the Federal Reserve Act, the Fed was established “to furnish an elastic currency, to afford means of rediscounting commercial paper, [and] to establish a more effective supervision of banking in the United States.”12 Since 1913, the Fed has been responsible for regulating the nation’s banking system and the value of its currency with the goal of promoting “maximum employment, stable prices, and moderate long-term interest rates.”13

While the Treasury Department is wholly public in nature, the Fed is not. As ordained by the original Federal Reserve Act of 1913, the Federal Reserve System is comprised of the Board of Governors of the Federal Reserve System (an independent agency sitting in Washington, D.C.) and twelve regional Federal Reserve Banks.14 The Board of Governors includes seven members appointed by the President with the advice and consent of the Senate and removable by the President for cause.15 The twelve regional Reserve Banks, on the other hand, are chartered as private corporations and operate, like other private businesses, at the direction of their individual boards of directors.16

The contemporary understanding of the Treasury-Fed division of power is that the Fed has control over monetary policy — the supply and demand of money in the economy — while the Treasury wields power over fiscal policy, or government taxing and spending. However, during the first period of its existence, the Fed did not operate wholly independently from the Treasury. During World War II, the U.S. government accumulated substantial debt to finance the war effort.17 Fed Chair Marriner Eccles — at the behest of the Treasury — kept domestic interest rates low18 in an effort to limit the cost of that financing.19 In 1951, the Fed broke from the Treasury’s control via the Treasury-Fed Accord, which enshrined the Fed’s independence and “ensure[d] that interest rate policy would be implemented to ensure the proper functioning of the economy, not to make debt financing cheap for the U.S. government.”20

Today, it is well settled that the Treasury, at the direction and under the authority of Congress, can collect and spend taxpayer dollars, while the Fed cannot.21 The Fed would be (indirectly) “spending” taxpayer money if it lost money — for instance, if it lent to a borrower and that borrower defaulted — because all profits earned by the Fed are returned to the Treasury and any losses on the Fed’s loans would reduce the amount the Fed could return.22 In short, the Fed’s profits are equivalent to taxpayer dollars, and spending those dollars is fiscal policy, which the Fed does not have the authority to conduct.23

B. Evolution of the Federal Reserve’s Lending Powers

Prior to the Great Depression, the Fed conducted monetary policy (that is, influenced the value of the nation’s currency) primarily by “discounting” the so-called “real bills” of its member banks24 through the discount window.25 “Discounting” was the process of lending a cash-poor bank some amount of dollars, collateralized by one of the bank’s assets, where the cash loan was less than the value of the asset (the “discount”). “Real bills” were short-term loans made by banks of the era to commercial, industrial, and agricultural entities and were used to finance the process of converting raw materials into manufactured goods (what today is called “commercial paper”).26

The Fed’s discounting of real bills was meant to accommodate seasonal variations in demand typical of the early twentieth-century economy, and — because the real bills had to be “endorsed” (that is, guaranteed) by the loaning bank — the Fed was protected from any losses.27 On top of the member bank’s endorsement, the Fed also retained the right to inquire into the financial health of the initial commercial, industrial, or agricultural borrower at its discretion.28 In short, the type of lending the Fed did in its early period of existence was quite limited, available only to its member banks, and relatively risk free.

Legislation passed in the wake of the Great Depression marked the end of the “real bills” era and the birth of the Fed’s true “lender of last resort” power. Section 10B of the Federal Reserve Act, enacted as part of the Glass-Steagall Act in 1932,29 enabled the Fed to “make advances,” or outright loans, to any of its member banks through the discount window so long as those advances were “secured to the satisfaction of” the Fed by acceptable collateral.30 The Glass-Steagall Act also expanded the types of securities eligible to serve as collateral beyond “real bills,” although the universe of eligible collateral was still initially quite narrow.31

Soon after section 10B was passed, section 13(3) — which, for the first time, allowed the Fed to discount the collateral of “any individual, partnership, or corporation,” in addition to its member banks — was enacted.32 As originally codified, it read:

In unusual and exigent circumstances, the Federal Reserve Board, by the affirmative vote of not less than five members, may authorize any Federal reserve bank . . . to discount for any individual, partnership, or corporation, notes, drafts, and bills of exchange . . . indorsed and otherwise secured to the satisfaction of the Federal reserve bank.33

Section 13(3) limited the financial instruments the Fed could discount for nonmember banks to those that were “eligible for discount for member banks” and again required those instruments to be “secured to the satisfaction of” the Fed.34 At the same time, however, section 13(3) dramatically expanded the universe of potential Fed borrowers, from member banks to virtually all private-sector entities. That is, the Fed could always extend credit to First National Bank, but after 1932 — in “unusual and exigent circumstances” — it could do the same for insurance companies, grocery stores, and everyone in between.35

II. The Fed in Crises

A. The 2008 Crisis and Response

Prior to the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act36 (Dodd-Frank Act) in 2010, the only elements of sections 10B and 13(3) that served to keep the Federal Reserve corralled on the monetary-policy side of the monetary-policy–fiscal-policy divide were the provisions that mandated the Fed to ensure its discount window loans were “secured to the satisfaction of [the applicable] Federal reserve bank.”37 For almost all of the twentieth century, ancillary restrictions on the kinds of collateral the Fed could discount under both sections 10B and 13(3) rendered these provisions somewhat redundant. The types of collateral accepted at the discount window were highly safe, near-cash substitutes, which ensured that the Fed’s loans were secured to the satisfaction of almost anyone.38

In particular, investment banks and other similar nonbank entities, whose balance sheets included mostly investment instruments, were ineligible for section 13(3) loans under the original collateral restrictions.39 The strict collateral-eligibility rules were repealed, however, by the Federal Deposit Insurance Corporation Improvement Act of 199140 (FDICIA). The passage of FDICIA meant that the Fed would actually have to reckon with how much risk it was willing to take on — that is, what it truly meant for a loan to be “secured to [its] satisfaction.”41

By the fall of 2008, amidst an imploding financial system, the Fed was under immense pressure to use its section 13(3) authority to make a number of loans to nonbank firms against questionable collateral — loans that neither the Fed nor the American public was certain could be paid back.42 In particular, the Fed came under fire for a $125 billion loan to American International Group (AIG) that was extended at a time when intense market turmoil undermined confidence in AIG’s ability to continue operations and, in turn, the Fed’s ability to liquidate the pledged collateral in the event AIG went under.43 How could this dubious loan have been secured to the Fed’s satisfaction?

The Fed’s aggressive use of section 13(3) in response to the Great Recession left congressional leaders on both sides of the aisle believing the agency had too much discretion in the use of its “lender of last resort” powers.44 In formulating the Dodd-Frank Act, Congress was cognizant of both the credit risk that (many argued) the Fed had taken on during the Great Recession as well as the American taxpayer’s heightened unwillingness to serve as the guarantor of the Fed’s risky loans. In other words, the Fed was creeping into fiscal-policy, and away from monetary-policy, territory.

Ultimately, the Dodd-Frank Act dramatically limited the Fed’s section 13(3) authority. While the Fed maintained its ability to lend to private-sector entities (beyond just its member banks), it could no longer lend to just any “individual, partnership, or corporation” — rather, the Fed could conduct section 13(3) lending only through a “program or facility with broad-based eligibility.”45 All section 13(3) loans had to be collateralized to “ensure protection for the taxpayer,”46 and the Board was required to “establish procedures to prohibit borrowing from programs and facilities by borrowers that are insolvent.”47 Further, the Fed could invoke section 13(3) only “for the purpose of providing liquidity to the financial system,” and all uses of section 13(3) now required prior approval of the Treasury.48

Many of the Fed’s defenders feared that the Dodd-Frank restrictions on section 13(3) would impede the Fed’s ability to intervene when the next financial crisis inevitably occurred. Then–Fed Chair Janet Yellen argued that any further limitations would serve to “essentially repeal the [Fed’s] remaining ability to act in a crisis.”49 More importantly, when all was said and done, whether the dramatic curtailment of the Fed’s powers was really warranted would be called into question. Ultimately, during the Great Recession, the Fed lost no money on its loans and actually earned profits of more than $30 billion — more than half of which were AIG related.50

B. The 2020 Crisis and Response

The COVID-19 pandemic would serve as a litmus test for whether the Fed’s emergency powers could sufficiently combat the next crisis. In early March 2020, in response to severe disruption in the financial markets occasioned by the COVID-19 pandemic, the Fed slashed the federal funds rate and resumed quantitative easing.51 It also offered direct support to the financial markets by lending to primary dealers, backstopping money market mutual funds, and expanding its repo operations.52

Further, at the direction of Congress and the Treasury, the Fed used its section 13(3) authority to open six lending facilities aimed at channeling credit to the real economy — that is, where “real” goods and services, but not financial assets, are exchanged.53 These facilities, described in the Table below, were structured as “special purpose vehicles” (SPVs), distinct legal entities with their own assets and liabilities, which remained off of the Federal Reserve’s balance sheet.54 To support the pandemic-beleaguered economy, the Fed then loaned money directly to those SPVs, which used that money to lend to — or, more often, purchase troubled assets from — certain sectors of the economy.55

What was so unusual about the Fed’s actions in March and April 2020? The Fed’s SPVs provided dollars to a variety of nonbank firms through the purchase of commercial paper, corporate debt, asset-backed securities, municipal paper, and other assets in which the Fed does not typically deal.56 In this way, the Fed played the role of “lender of last resort” to the real economy — to nonbank financial firms, ordinary businesses, and local governments — as opposed to just its member banks (or even just the financial sector, as it did in 2008).

Thankfully, the Fed’s actions worked, and quickly. After the programs were launched, the widening of corporate-bond spreads immediately halted, and the tightening of credit standards across the economy subsided.58 Economists have characterized the Fed’s actions as helping to “avoid both an amplification of the economic downturn and some of the financial frictions that impeded the recovery from the Great Recession.”59 For all intents and purposes, the Fed’s actions were a success.

As previously mentioned, in the aftermath of the Great Recession, frustration over the Fed’s purported “bailing out” of firms spurred Congress to restrict the Fed’s section 13(3) authority via the Dodd-Frank Act.60 Similar attempts to circumscribe the Fed’s powers followed the Fed’s COVID-19 response.61 While these attempts have been far more limited than those that followed the Great Recession, they are consistent with a persistent pattern in postcrisis response: regardless of how successful the Fed is, politicians will insist upon further limiting the Fed’s emergency lending authority.

III. The Letter of the Law: Tensions with Section 13(3) of the Federal Reserve Act

In the wake of such a striking display of power, many questioned whether the Fed’s COVID-19 response was a “valid exercise[]” of the Fed’s statutory authority under section 13(3).62 Some scholars (like Professor David Zaring) felt that, while the Fed’s response may not have been illegal, the Fed stretched its statutory authority.63 Others asserted that the intervention affirmatively overstepped one or more provisions of Section 13(3): Professor Lev Menand, for example, pronounced a fundamental “mismatch between the Fed’s ad hoc programs and the baseline rules that govern its lending.”64 This Part discusses the major provisions of the Federal Reserve Act with which scholars felt the Fed’s COVID-19 response was incompatible and articulates why the Fed’s actions were within the letter of its statutory mandate.

A. Tension 1: Section 13(3)’s Collateral-Adequacy, Taxpayer-Protection, and Borrower-Solvency Requirements

One of the major Dodd-Frank Act amendments to section 13(3) was the requirement that all section 13(3) loans be collateralized “consistent with sound risk management practices” in an effort to “ensure protection for the taxpayer.”65 Today, the Fed is required to assign a “lendable value” to collateral for any loan executed by a Reserve bank pursuant to section 13(3), ensuring the Fed can sell the collateral if the borrower is unable to repay the loan and taxpayers are not at risk of bearing any losses.66 Further, the Fed must make efforts to guarantee that insolvent firms do not have access to any of its programs or facilities.67

Given section 13(3)’s newly minted collateral-adequacy, taxpayer-protection, and borrower-solvency requirements, it comes as a surprise that the credit extended by the Fed through its off-balance-sheet credit facilities was, in some respects, anything but risk free. For one, many of the businesses whose loans were purchased by the Main Street Lending Program (MSLP), if only by virtue of their size, lacked any collateral whatsoever of the kind typically accepted by the Fed.68 But the MSLP borrowers were not the only ones questionably collateralized. Other than the Term Asset-Backed Securities Loan Facility (TALF), the Fed’s off-balance-sheet credit facilities had no real “collateral” at all, as the loans to the SPVs were backed solely by the assets the SPVs had purchased, and none of the facilities provided any recourse back to the actual sellers of the assets.69 Further, various “loss-saving” features of the SPVs — such as the charging of a few basis points to firms selling assets into the facilities70 — implied that the Fed itself expected some of the end borrowers to default.

Add to this the fact that, by the fourth quarter of 2020, bankruptcy filings in the United States were at their highest rate since 2013 and the annual number of companies defaulting on their debt was on its way to eclipsing the same for any year of the Great Recession.71 Further, as the crisis was unfolding, asset prices fluctuated wildly, rendering it nearly impossible to value firms with any degree of certainty.72 In this environment, the Fed did not and logistically could not have guaranteed that all of the entities accepting loans made by its pandemic-era SPVs or the issuers of the debt purchased by its pandemic-era SPVs were solvent.

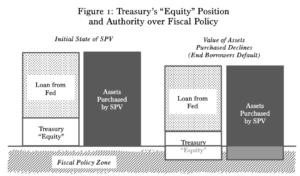

Unsurprisingly, scholars were quick to note the tensions between the Fed’s actions and section 13(3)’s post–Dodd Frank collateral-adequacy, taxpayer-protection, and borrower-solvency requirements.73 How could the facilities possibly fit within the now-even-more strict boundaries of section 13(3)? While the off-balance-sheet facilities received their principal funding from the Fed, some fraction of their funding came from the Treasury.74 The funding received from the Treasury was held on each of the SPVs’ balance sheets as “equity.”75 Treasury’s equity position in the SPVs served as a backstop against Fed losses for all of the off-balance-sheet facilities that were not inherently risk free: net losses on any of the facilities would simply reduce Treasury’s equity position.76

In this way, the Fed satisfied section 13(3)’s collateral-adequacy and taxpayer-protection requirements. Treasury funds were used to protect the Fed both financially and legally; taxpayers were exposed to losses, but through the money that Congress had appropriated to the Treasury, rather than the Fed.77 In other words, because the Fed made no loans directly to any end borrowers, the section 13(3) determinations of collateral adequacy and taxpayer protection could be made at the level of the SPV. With the Treasury’s funding from the Coronavirus Aid, Relief, and Economic Security Act78 (CARES Act) serving as a backstop for all six facilities, the Fed was able to satisfy the letter of section 13(3).79

With respect to section 13(3)’s borrower-solvency requirement — which requires the Fed to “establish procedures to prohibit borrowing from programs and facilities by borrowers that are insolvent”80 — the Fed’s facilities were also in full compliance with the Federal Reserve Act. For one, most of the SPVs purchased assets instead of extending loans. Therefore, most of the facilities lacked “borrowers” in any true sense of the word, rendering the statute’s solvency requirement arguably inapplicable.81

More importantly, however, the Fed did “establish procedures to prohibit” insolvent borrowers from taking advantage of the facilities: for instance, borrowers from the MSLF were required to certify that they “ha[d] the ability to meet [their] financial obligations for at least the next 90 days and [did] not expect to file for bankruptcy during that time period.”82 In fact, this standard for insolvency — which is forward looking — is stricter than that found in the Fed’s Regulation A.83 In reality, then, the Fed went “above and beyond” with respect to the terms of section 13(3)’s solvency requirement.

B. Tension 2: Section 13(3)’s Mandate of “Providing Liquidity to the Financial System”84

Section 13(3) of the Federal Reserve Act also mandates that the Fed establish emergency lending facilities only “for the purpose of providing liquidity to the financial system.”85 This requirement, too, was added to section 13(3) via the Dodd-Frank Act.86 Spurred by public outcry during the Great Recession over the perceived “bailout” of nonbanks by the Fed, Congress inserted the provision into Dodd-Frank to ensure that the Fed remain faithful to its mandate of liquidity provision.

The Fed has also come under fire for circumventing this statutory provision. Critics argued that the Fed’s COVID-19 facilities were not designed to provide “liquidity to the financial system” but rather were intended to “lend to the real economy as a limited purpose national investment authority.”87 That is, while the Fed claimed that it was attempting only to restore the flow of credit throughout the financial system, the Fed was actually making investments in specific sectors of the real economy.

Menand has written that the 2010 addition of the “liquidity to the financial system” provision to section 13(3) was intended to “leave[] [the Fed] with the power only to create facilities to provide liquidity to nonbank financial firms” — not to real-economy actors.88 Under this interpretation, the Fed’s facilities per se violated section 13(3) by channeling liquidity to the nonfinancial economy: to ordinary businesses, local and state governments, and other nonfinancial firms. In this way, Congress’s CARES Act directive to the Fed to provide support to the real economy amounted to “amend[ing] 13(3), in effect, sub silentio.”89

But if Congress intended, through the Dodd-Frank Act, to limit the Fed to providing liquidity only to nonbank financial firms, it very easily could have said so when it amended section 13(3). Congress explicitly limited the Fed’s use of section 13(3) to “providing liquidity to the financial system” — and prohibited the Fed from supporting individual real-economy actors — but never indicated the Fed could provide liquidity only to financial firms.90 Further, it cannot be that the “liquidity to the financial system” provision implies that the Fed has the statutory ability to support only banks and financial firms (and not the real economy) because “support for the real economy is the ultimate purpose of providing liquidity to the financial system, and of having a financial system in the first place.”91

By late March 2020, economic activity in the United States had “ground . . . to a halt,” and credit markets across all sectors of the economy froze.92 Everyone — not just banks and other financial firms — was struggling to obtain financing for their day-to-day operations. The CARES Act instructed the Fed to “provid[e] liquidity to the financial system that supports lending to eligible businesses, States, or municipalities.”93 With the end goal of supporting these cash-strapped real-economy entities, the Fed channeled liquidity to the financial firms sitting opposite those real-economy actors in financial-market transactions: the Primary Market Corporate Credit Facility and the Secondary Market Corporate Credit Facility targeted financial firms in the corporate-credit market, the Municipal Liquidty Facility (MLF) sought to reach financial actors operating in the municipal-debt market, and so on.94 If this is not “providing liquidity to the financial system,” then what is?

IV. Debunking the Myths

While the Fed may have stayed within the letter of the law, it certainly challenged the law’s spirit. In retrospect, however, many of the qualms and critiques leveled by politicians and scholars alike that were prominent in the postcrisis narrative have proven less troubling than they seemed in the midst of the crisis. This Part aims to evaluate, with the benefit of hindsight, how the most enduring of these critiques have fared.

A. Unprecedented Scale and Scope

One major source of discomfort with the Fed’s COVID-19 response was the unprecedented nature of both (a) the amount of relief offered by the Fed and (b) the range of entities to whom relief was offered. Economist George Selgin highlighted how the Fed’s COVID-19 response “exceed[ed] [the] scale and scope” of prior Fed interventions by effectively lending to ordinary businesses and state and municipal governments, as opposed to banks and financial firms.95 Zaring characterized the Fed’s actions as “pumping almost every asset class, including ones never supported before, full of cash in an effort to extend credit to almost any firm that [needed] a loan to survive.”96

Before this Note specifically addresses the scale and scope of the Fed’s COVID-19 lending, it is important to establish that there is nothing new about the way the Fed conducted its lending. During the Great Recession, the Fed set up three SPVs — Maiden Lane LLC, Maiden Lane II LLC, and Maiden Lane III LLC — to which it lent over $70 billion dollars.97 Those facilities then purchased troubled assets from Bear Stearns, risky residential mortgage-backed securities from subsidiaries of insurance giant AIG, and collateralized debt obligations from certain AIG counterparties, respectively.98 All three facilities were justified as exercises of the Fed’s section 13(3) authority.99 All three facilities channeled credit to nonbanks for the ultimate purpose of lessening the impact of the crisis on the real economy.

Further, in drafting the Dodd-Frank Act, Congress was explicit about which elements of the Maiden Lane facilities it disliked, expressly precluding them through its revisions to section 13(3). For instance, the revised section 13(3) prohibits the Fed from opening a facility to “remove assets from the balance sheet of a single and specific company.”100 This provision was added to prevent the Fed from using section 13(3) to purchase the struggling assets of an individual, favored company, as critics argued it had done with AIG.101 The revised section 13(3) similarly forbids the Fed from “assisting a single and specific company avoid bankruptcy,”102 as it did when it used section 13(3) to rescue Bear Stearns from filing for Chapter 11 bankruptcy.103 Congress never restricted the ability of the Fed to utilize SPVs for the purposes of emergency lending. Nor did it place specific industry- or sector-based restrictions on the kinds of assets (for example, municipal bonds or asset-backed securities) such facilities could purchase for the purposes of abating financial-market stress.

Moving to the scale of the Fed’s actions — in terms of the dollar amount of credit extended — in retrospect, the Fed’s COVID-19 response was far from the most aggressive use of the agency’s section 13(3) powers. The peak amount extended by the Fed’s off-balance-sheet credit facilities was under $150 billion in mid-April, plummeting to under $25 billion by May 2020.104 The peak outstanding balance of all lending authorized by the Fed’s Section 13(3) authority during the COVID-19 crisis (including the off-balance-sheet credit facilities) was $197 billion.105 Contrast this with November 2008, when the Fed’s section 13(3) authority supported more than $710 billion in outstanding loans — and with fewer statutory safeguards.106 In 2020, the Fed had a relatively limited number of chips on the table.

As to the scope of the Fed’s actions, however, it is hard to argue that the Fed’s COVID-19 response was not unprecedented. After all, the Fed used its SPVs to channel credit to areas of the economy (like municipal governments and small businesses) to which it had never, in the modern era of section 13(3), channeled credit before. But, while the Fed’s sprawling intervention may have been unprecedented, it was not unwarranted: the Fed’s expansive response was necessitated by and tailored to meet a liquidity crunch that was equally broad in scope. Unlike in 2008, when the financial crisis was concentrated in the financial sector and in real estate, COVID-19 crippled financial markets across the real economy. Both Wall Street and Main Street were struggling to meet their day-to-day financing needs, and limiting credit extension to the former would have significantly stalled the postcrisis recovery.

Importantly, the scope of the Fed’s actions was decidedly not unprecedented in terms of executive branch domestic financial-market intervention across the nation’s history. The Fed’s COVID-19 response is eerily reminiscent of the work of the Treasury-funded Reconstruction Finance Corporation (RFC) of the New Deal era, which purchased banks’ stocks and unsecured debt instruments and lent to railroads, ordinary businesses, states, and municipalities in an effort to provide relief to the economy in the midst of the Great Depression.107 Critically, the RFC was created to fill in the gaps left by the statutory limitations on the Fed’s Depression-era emergency lending powers discussed in section I.B.108 In the absence of section 13(3), the New Deal Congress had to craft a “lender of last resort” for the real economy on the fly in the middle of a devastating economic downturn.

B. Risk of Taxpayer Losses and the Intrusion on Fiscal Policy

Another major source of discomfort with the Fed’s COVID-19 response is the extent to which the Fed risked taxpayer money and consequently drifted into the realm of fiscal policy. Zaring argues that the CARES Act invited the Fed to overstep its monetary policy authority by “using its [own] balance sheet to extend credit to all sorts of American businesses.”109 Professors Christine Desan and Nadav Orian Peer further contended that the Fed and the Treasury together “subvert[ed] the traditional modes of constitutional legitimacy” by structuring the COVID-19 facilities in a way that “le[ft] each facility directly exposed to the credit risk of end-borrowers,” effectively usurping the power of the purse from Congress.110

This Note does not dispute the fact that the Fed’s COVID-19 facilities were exposed to the credit risk of corporations, local governments, and other end borrowers. Critically, however, the taxpayer money that was threatened by the Fed’s actions was wagered by the Treasury — appropriated to the cause by the CARES Act — and not by the Fed. By design, all losses on the facilities were to be covered first by money contributed to the SPVs by the Treasury.111 Further, the strict terms of the facilities were designed to ensure that only the Treasury was at risk of losing money (that is, the terms ensured that losses on the facilities would not exceed Treasury’s “equity” backstop).112

In addition to the fact that the Treasury was the only agency that effectively put taxpayer money at risk, the Treasury was also the sole agency in charge of credit allocation done by the facilities. The CARES Act specified that all credit extended through the Fed’s SPVs “shall be [extended] . . . in such form and on such terms and conditions and contain such covenants, representations, warranties, and requirements (including requirements for audits) as the Secretary determines appropriate.”113 In other words, although the SPVs were to be “[e]stablished by the Fed,”114 they were to be operated by the Treasury. And if that wasn’t clear enough, the next sentence of the Act terms the credit extended under the section specifically as “loans made by the Secretary.”115

Still, uneasiness remains. For some, the underlying source of discomfort is not that taxpayers lacked protection per se but rather that the protection was inadequate.116 Importantly, the Fed went to great pains to ensure that Treasury’s backstop would be sufficient to cover all losses on the facilities; as this Note has previously mentioned, all programs backed by CARES Act funding were subject to strict size and risk limitations.117 Further, the Fed never lost any money on any of the facilities. In fact, as of early February 2021, the Fed actually earned $405 million on the facilities,118 and the Treasury lost only $25 billion — less than six percent — of its initial investment.119

Did the Fed just get lucky this time? If the COVID-19 crisis were to play out again, it is not certain that the protective actions (for example, overcollateralization) taken by the Fed and the Treasury would be sufficient to fully insure the facilities against Fed losses. But hindsight indicates that, this time, the Treasury’s backstop was sufficient more than ten times over. The Treasury-Fed risk calculus should be watched going forward, but the 2020 experience ought to be reassuring.

C. Picking Winners and Losers

A third concern surrounding the Fed’s COVID-19 response is not that taxpayer money was at risk but who put it at risk. To some extent, this concern stems from the vagueness of Congress’s directions to the Treasury regarding how to distribute the CARES Act money allocated to the Fed’s facilities — the decisions entrusted to the Treasury were “the sort of policy decisions that should be left to Congress.”120 To these scholars, the CARES Act amounted to a constitutionally illegitimate delegation of the power of the purse not to the Fed but to the Treasury.121

Admittedly, section 4003 of the CARES Act is remarkably vague: the provision appropriates “[n]ot more than the sum of $454,000,000,000 . . . to make loans and loan guarantees to, and other investments in, programs or facilities established by the [Fed] for the purpose of providing liquidity to the financial system that supports lending to eligible businesses, States, or municipalities.”122 The language leaves Treasury quite a bit of wiggle room. Still, Congress’s vagueness ought to be excused at least to some degree by the emergency at hand. Shepherding a detailed and comprehensive COVID-19 relief budget through the United States’s characteristically slow legislative process in March 2020 may well have proved impossible.

Further, while there is indeed ambiguity in Congress’s CARES Act directions to the Treasury, the appropriations typically made by Congress are no more precise. As just one recent example, the Build Back Better Act123 — the proposed federal budget for fiscal year 2022 — allocated $30 billion to the Secretary of Energy to “guarantee loans”124 for projects that “avoid, reduce, or sequester air pollutants or anthropogenic emissions of greenhouse gases [and that] employ new or significantly improved technologies”125 and $20 billion to the Department of Health and Human Services for the purpose of “administer[ing] a child care and early learning entitlement program [allowing families] to obtain high-quality child care services.”126 These directions are arguably just as nebulous as those found in section 4003.

Even if the delegation was constitutional, however, there is rightfully hesitation with permitting the Treasury, in concert with the (purportedly independent) Fed, to choose where such a huge sum of public money should go. Amidst the crisis, the notion that the Fed was effectively “picking winners and losers” was a common refrain.127 Still, in retrospect, this concern too was unfounded. Because the Fed’s facilities were underutilized, no willing borrowers otherwise meeting baseline eligibility criteria were turned away; the Fed did not have to pick winners and losers because there was more than enough Fed support to go around.128 The discretion exercised by the Fed was ultimately minimal.129

There is a possibility, in the future, that the demand for credit from a section 13(3) facility will exceed its supply, placing the Fed in the position of “picking winners.” But the Fed sets interest rates on these facilities at a “penalty rate” (a “premium to the market rate in normal circumstances”) and “discourages [their] use . . . [as] economic conditions normalize.”130 In other words, demand for section 13(3) credit is dampened by design, and, as 2020 made clear, firms will seek credit from private-market alternatives as soon as it is possible to do so. The Fed is a lender of last resort: its borrowers come to it, and not the other way around.

D. The Lack of a Limiting Principle

A final element of the Fed’s COVID-19 response that caused concern was the seeming lack of any kind of limiting principle. While the Fed’s section 13(3) authority may be used in only “unusual and exigent circumstances,”131 what circumstances constitute unusual and/or exigent remains unclear. Further, 2020 demonstrated that the requirement that the Fed exercise its section 13(3) powers only through a program with “broad-based eligibility”132 does little to limit whom the Fed can elect to support — and not support — amidst a crisis. As Menand has written, if the Fed’s lending in March and April 2020 meets the requirements of section 13(3), then “any lending meets the requirement(s) [of section 13(3)].”133

The Fed has a lot of power. But the notion that it can exercise its section 13(3) authority whenever and however it chooses is plainly incorrect. First and foremost, all exercises of the Fed’s section 13(3) authority require “prior approval of the Secretary of the Treasury.”134 The Treasury serves as a statutory gatekeeper of the Fed’s ability to do anything involving fiscal policy — a gatekeeper that both is politically accountable and has proven unwilling to let the Fed dictate the terms of its section 13(3) lending. Treasury Secretary Steven Mnuchin unilaterally elected to shut down all of the off-balance-sheet credit facilities other than the Commercial Paper Funding Facility at the end of 2020, against the wishes of Fed Chair Jerome Powell.135

Additionally, while the Fed may have brandished a lot of authority in March and April 2020, it did not actually exercise it. In large part, the mere announcement of the Fed’s COVID-19 facilities was sufficient to restore liquidity across the financial system, and the facilities themselves were only minimally utilized.136 For instance, the MLF purchased only two issues of municipal securities in its first six months of operation; private-sector investors purchased $250 billion in new municipal bonds, restoring precrisis market volume, during that same period.137 In other words, while the Fed’s announced intervention may have been huge, its actual intervention was quite limited.

It is not guaranteed that the Treasury will be an effective gatekeeper in the future, nor is it predetermined that the “announcement effect” of future Fed facilities will restore market functioning in the way it did in 2020. But the 2020 experience should put to bed the notion of an all-powerful Fed with unbounded ability to determine the financial livelihood of the American people.

Conclusion

With the benefit of hindsight, concerns surrounding the Fed’s COVID-19 response — specifically, the overstepping of statutory authority, the unprecedented scale and scope, the intrusion into fiscal policy, the picking of winners and losers, and the lack of a limiting principle — seem far less ominous than they did in the spring of 2020. Reckoning with the validity of these criticisms is particularly important in a world where central banks face shrinking monetary-policy toolkits and ongoing political threats to their crisis-fighting capabilities. Crucially, one of the principal aggravators of the Great Depression was the Fed’s inability, prior to the substantial expansion of the Fed’s power in the 1930s, to adequately serve as a “lender of last resort” for the nation’s economy.138 Leaving the Fed without sufficient ammunition to fight the next crisis could prove equally disastrous.