In an essay on “Affirming the American Family” for the fall 2019 issue of American Affairs, Maria Molla and I outlined a proposal for a new family benefit program in the United States. Under the name of FamilyPay, our proposal has three aims: (1) to resolve the demographic problems caused by America’s low birth rate; (2) to significantly reorient the American economy toward the family; and (3) to offer a proposal that would promote a common good (strong families) that Americans by and large say they support.

In this piece, we wish to address some common macroeconomic questions that have arisen due to the magnitude of our proposal. As background, the FamilyPay program we have advocated would provide an annual cash benefit of $6,500 to married couples with one child, $11,500 to a family with two children, and $17,000 to a family with three. The program would have declining marginal increases for subsequent children and also have family-oriented restrictions on spending (a CarePoints card to deliver the restricted benefit).

To the extent that we addressed the macroeconomics of FamilyPay, we only addressed its impact on the federal budget. At the current fertility rate of 1.8, the program would cost around 6.5 percent of GDP. At the target fertility rate of 3, the cost would rise to 8.7 percent of GDP. We noted that the bulk of the financing would come from borrowing and we estimated that this would require the federal government to initially borrow an amount equivalent to 5 percent of present GDP.

Some commentators have balked at this number. Such a program, they point out, is exceptionally large—a fact we readily grant. Indeed, these amounts are large by design, as we criticized the ineffectiveness of small financial incentives as well as of incentive “packages” that offer disaggregated benefits (childcare, family leave, etc.) rather than lump payments. If the program were any smaller, it would be simply another attempt to “tweak” family incomes through the tax system that would have no impact on family formation behavior at all.

Macroeconomic Impact of FamilyPay

Since the release of our proposal, it has become clear to us that many people are not attuned to the impact such a program might have on the economy. Policymakers and academics alike do not seem to grasp what a program of this size might entail. In what follows we will try to sketch out, using basic macroeconomic analytical tools, what impact the program would have on economic growth, inflation, and the government budget.

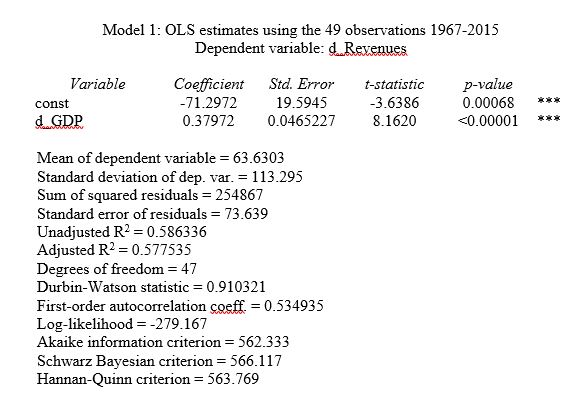

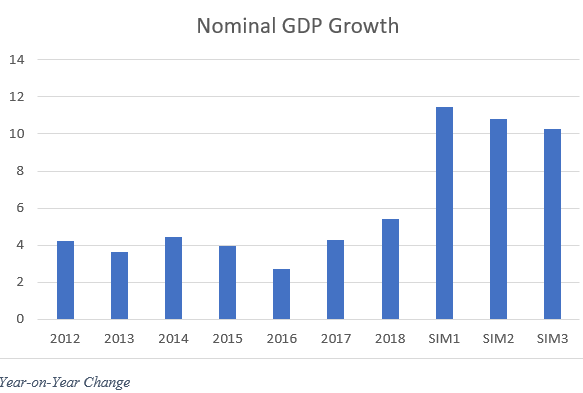

We will start by discussing the immediate impact the expansion of the fiscal deficit will have on nominal GDP growth. This operation is simple enough—we must estimate the size of the Keynesian fiscal multiplier, which tracks the effects of increased spending on national output. As points of reference, Alan Blinder and Mark Zandi estimated the fiscal multiplier of unemployment benefits during the 2008–9 downturn to be around 1.61, and the CBO estimates the multiplier of both unemployment insurance and food stamps to be about 1.45. Our program differs from these other benefits due to the savings incentive offered by CareBonds: recipients of FamilyPay will be incentivized to save by receiving a 20 percent premium on 10-year U.S. Treasurys for any portion they save. This will consequently lower the fiscal multiplier, so we will estimate the Keynesian fiscal multiplier of FamilyPay to be around 1.2. This estimate gives rise to nominal GDP growth numbers as follows.

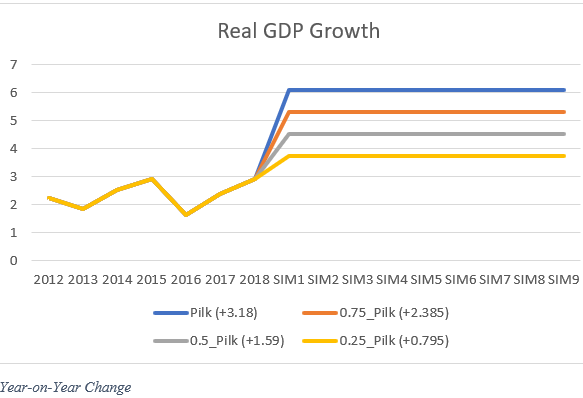

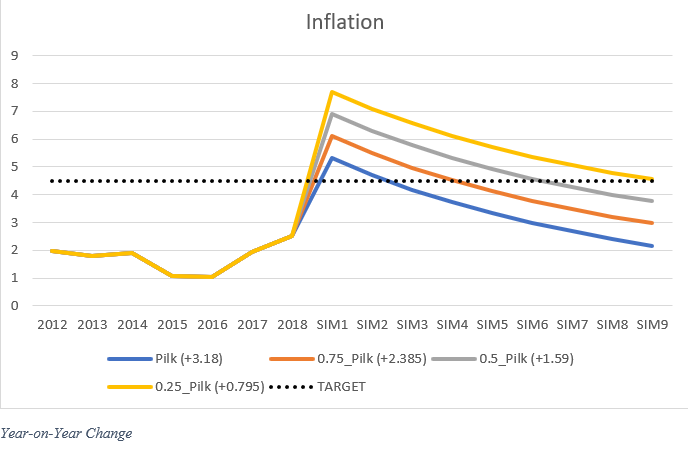

Much of this growth will be inflation. The extent to which FamilyPay will generate inflation rather than real output growth depends on the amount of slack left in the economy for the sorts of goods and services that are purchased with FamilyPay. That is, it depends on how much capacity (factories, etc.) can increase the supply of goods to meet the new demand that comes online when the program expenditures are disbursed to families. We take as our baseline for this estimation an intriguing attempt last year by Philip Pilkington to estimate potential GDP using capacity utilization. We think, however, that Pilkington’s estimate of a 3.18 percent potential supply expansion may too optimistic for some. For this reason, we have included alternative estimates—one 75 percent of Pilkington’s estimate (2.385 percent), another half the size (1.59 percent), and another 25 percent the size (0.795 percent). These various estimates generate the following real GDP growth and inflation estimates.

As the chart indicates, if the economy is already near production capacity, then a low potential supply expansion (25 percent) will lead to a lower year-on-year GDP growth and higher year-on-year inflation, whereas a full supply expansion will have the highest GDP growth and lowest inflation.

The reader will note that we have set a target rate of inflation of 4.5 percent. This rate is more than double the rate set by the Federal Reserve, but we believe that the Federal Reserve’s target is arbitrary. Instead of targeting an arbitrary rate of inflation, the U.S. government could be using its fiscal capacity to fix long-term demographic problems that threaten the future of the country. When faced with a declining demographic situation, concerns about inflation seem overwrought.

That said, if the program is undertaken and it turns out that there is not much spare capacity left in the economy and inflation jumps to over 7 percent, we think it would be reasonable for the Federal Reserve to raise interest rates to temporarily stifle economic growth and get prices under control. As the economy emerged from the ensuing recession, inflation would be subdued, and the program would be firmly in place—helping to generate substantial economic growth moving forward.

Budgetary Impact: Tax Reflux

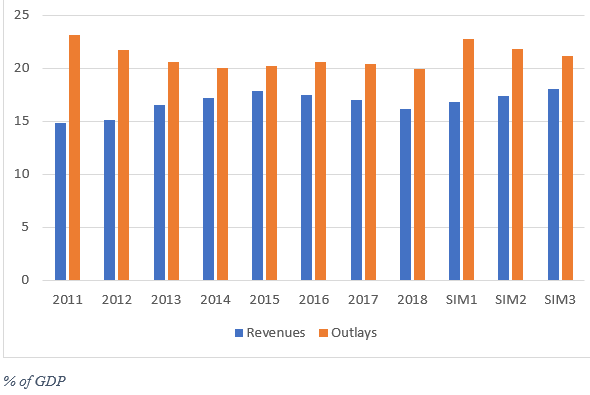

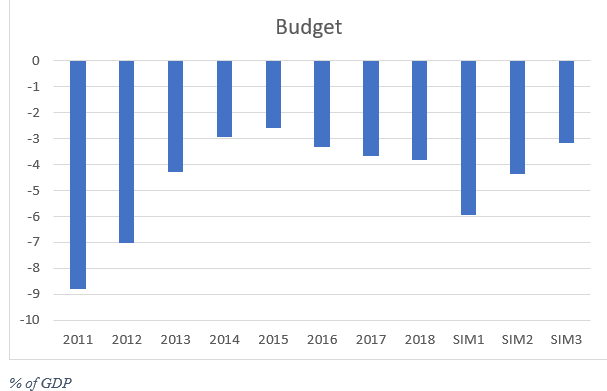

Next we would like to address concerns about the impact that the program will have on the budget, as it would require an immediate additional rate of borrowing at 5 percent of GDP. What “fiscally conservative” critics of the proposal have not noticed, however, is that once the new spending comes online, much of it will reflux back to the Treasury in the form of higher tax revenues. Concerns about the impact of such a budget expansion are thus also overstated.

The reflux comes about because the money that is spent by the families that receive it will generate revenue for companies and income for workers. Some of this revenue and income will then accrue to the federal government in the form of increased tax revenue. The key sources of this will be individual income tax, corporate income tax, social insurance or payroll tax, and excise taxes. The average individual income tax rate together with the payroll tax rate in the United States is around 31 percent, while the corporate income tax is 21 percent.

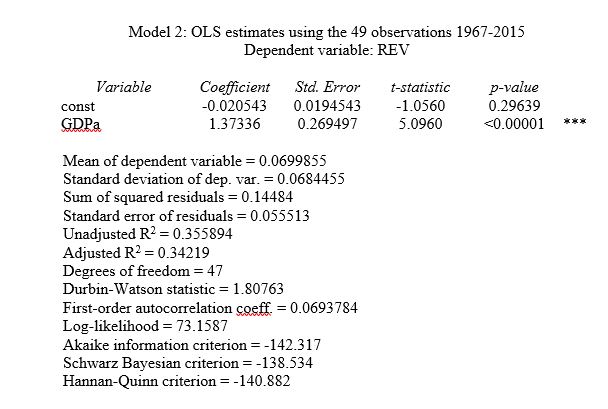

Based on a simple regression on tax revenues and GDP (see appendix, Model 1 and Model 2), we estimate that for every dollar GDP increases, tax revenues rise 37 cents. Using these figures, we can simulate the impact on the government budget below.

As we can see, we expect the peak in the budget deficit to be substantially lower than it was in 2011 (–8.8 percent of GDP), not to mention the even larger peak of over 10 percent in 2008–9. Soon after this, as GDP and tax revenues grow the budget shrinks back to normal levels.

Redistribution and Domestic Production

FamilyPay would also include a three-part macroeconomic redistribution. While these consequences flow from the original design, in our essay for American Affairs we did not have space to spell them out.

The first component is that FamilyPay redistributes spending power toward poorer families. In the program a family with married spouses and three children receives $19,000. For a low-income family earning, say, $30,000 a year, this represents a rise in income of 63 percent. Meanwhile, for a wealthy family earning $120,000 a year, this represents a rise in income of only 16 percent. This redistribution will also have regional effects, pulling spending power away from the major cities and toward smaller towns, thereby rejuvenating their local economies.

The second component of the redistribution is that the inflation that we do see will be non-neutral. That is, the prices of some goods will rise more than others. Since the program is directed at families and some of it is disbursed in the form of CarePoints (an expenditure card tied to family expenses), in the short term the prices of family-related expenditures—furniture, diapers, children’s clothes, etc.—will be greater than for non-family-related expenditures. This rise in prices will encourage entrepreneurs to invest more heavily into these sectors to capture the rising profits. That in turn will lead to a major restructuring of the U.S. economy so that family life becomes central—even in many peoples’ work lives.

The third component, which we did not propose initially, would be to restrict the spending of CarePoints to U.S.-produced goods, thus providing a further benefit to the domestic economy and an additional tax reflux (through domestically collected corporate taxes). This plan would involve giving American companies the opportunity to apply to the U.S. government certifying that they produce, on U.S. soil, products geared toward childcare. The spending of CarePoints would then be restricted to these goods. To ensure domestic competition, if multiple companies apply for certification, then the consumer would be given the choice among the products of these companies. The only products excluded would be foreign-produced products. If no domestic companies applied for a given product category, then foreign products could be bought with CarePoints.

The FamilyPay program would thus have three crucially important macroeconomic effects: it would provide spending power to low-income families, it would encourage corporations to invest heavily in family-related products, and it would encourage the domestic production of those products.

Against a Technocratic Interpretation of the Program

When assessing a macroeconomic program, policymakers often engage in cost-benefit analysis. They weigh up, for example, the trade-off between inflation and unemployment. Implicit in this weighing-up is that inflation and unemployment are as important as one another. Whatever one thinks of this judgment in other contexts, we do not believe that it applies in the case of the fertility of a nation. Admittedly, FamilyPay program is a technocratic program insofar as it attempts to use tools of the state and a robust incentive restructuring to bring about an increase in domestic population. But we are very cautious about interpreting it in a narrowly technocratic way.

A nation cannot grow without a growing population. Relying on immigration for population growth entails some level of political instability. There is also mounting evidence that the breakdown of family life is harming the social fabric of Western nations. Statistics and macroeconomic arguments aside, however, a society that cannot reproduce itself is a dying society. For this reason, we argue that raising the fertility rate and promoting vibrant family life is more important than abstract numbers like GDP, inflation, or the government budget deficit.

One of the more surprising objections that we have faced since we released the program is that we are too technocratically minded. Some critics have pointed out that having parents treat their children as a source of income is cynical and unsentimental. But such criticisms reveal more about contemporary culture than they do about our proposal. In most societies, parents have looked on children in part as a source of labor and thus income; more simply, they have valued children in the fullest sense. Indeed, this remains the expectation in many developing economies—precisely the ones that have high birth rates. Much emigration to developed countries is motivated by parents sending their children away to earn foreign income that is then transferred back to family in the poorer country. Our program is not a technocratic intervention into people’s emotional lives.

Instead, FamilyPay is an attempt to reorient social and familial relationships toward an essential element of the common good. Broadly successful family formation, family life, and childrearing is just such a good.

Appendix